The American Psychological Association’s March, 2022, Stress in America survey found that 72 percent of Americans reported feeling stressed about money at least some time in the prior month. Clearly, money and finances are a frequent source of concern for many people.

Financial stress is often defined as worry or anxiety related to money or finances but that is not actually correct, as we’ll see below.

What is Financial Wellness?

Before defining financial stress, we should define financial wellness. As one might expect, financial wellness includes:

- Being able to pay your bills

- Being able to manage your finances

- Being able to effectively weather financial emergencies

- Being able to meet your long-term financial goals

- Being able to plan and save for retirement

Someone who can do those things is not likely to be losing a lot of sleep worrying about finances.

What is Financial Stress?

Financial stress is pretty much the opposite of financial wellness. People suffering from financial stress are not likely to be able to manage their finances well. They may have frequent problems paying their bills. Unexpected financial emergencies can turn into major life disasters and saving for retirement is often neglected completely.

In that environment, it’s not surprising that someone would be stressed, worried, anxious and maybe depressed. But financial stress is not all of those things. In our 10-part series on stress, we learned that stress is our body’s automatic, biochemical reaction to a stress. Stress itself is neither positive nor negative. What is positive or negative is how we choose to respond to that stress.

So while it may be stressful to get another bill in the mail, knowing that there’s no money to pay for it, the stress part is the mail itself. We get to choose how to react to that stress, even if sometimes it feels like we have no choices available to us at all.

Is Financial Stress Different Than Other Kinds of Stress?

Financial stress is different from other stress only in the trigger. Financial stress comes in the form of a pile of bills, an overdrawn checking account, a shouting landlord or an empty cupboard. Other stressors may look or sound different (a baby crying again, children fighting, a boss insisting we work late again, an unreasonable spouse, a mother who is dying) but our body will react to all of those things in the same way.

That’s actually a good thing because we know a great deal about how to recognize stress, prevent it, manage it and cope with it. Techniques that work with other kinds of stress will help with financial stress, too.

Who Does Financial Stress Usually Effect?

Nor surprisingly, financial stress has an indirect relationship with how much money someone has. People with lots of resources are far less likely to have financial stress than those who are just barely getting along.

That’s another good thing to know because it suggests one way of combating financial stress: getting our finances in order. We’ll talk more about that below.

Symptoms of Financial Stress

Common symptoms of financial stress include:

- Avoiding opening bills because you can’t afford to pay them.

- Not answering the phone because you don’t want to talk to creditors.

- Putting off all financial decisions because they’re just too complicated to deal with.

- Never having enough money to pay your bills.

- Getting angry at people you owe money to.

- Feeling anxious or worried or depressed when you think about money.

Why is Financial Stress Dangerous?

Almost all stress is dangerous. In Types of Stress, we learned that stress comes in three basic forms:

- Acute stress that just shows up and then goes away.

- Episodic stress that recurs periodically.

- Chronic stress that never goes away.

Financial stress can take any of those forms.

If you’re doing okay with money but suddenly have to pay an unexpected funeral bill of $15,000, that would likely be stressful. With some effort, you figure out how to pay it and get on with your affairs. That’s an example of acute financial stress.

If you feel great most of the time but get extremely anxious at the beginning of the month when you have to pay your monthly bills, that would be an example of episodic stress.

But, for most people who experience financial stress, the stress never really goes away. It’s always there, always a problem, always restricting your life and your happiness. This is chronic financial stress.

In The Effect of Stress on Our Bodies, we saw that stress causes inflammation. Chronic stress causes chronic inflammation – inflammation that never goes away. Chronic inflammation is tied to half of all human disease and deaths.

As one of the most common sources of chronic stress, financial stress poses real dangers to the health, life and happiness of those who are dealing with it. And, unfortunately, financial stress is often a contributor to suicide.

The Impact of Financial Stress on Our Lives

We looked at the typical impacts of stress in The Effect of Stress on Our Bodies and The Impact of Stress on Our Brains, Minds and Lives. Those articles are worth reading for anyone who is dealing with stress.

The lack of resources that often accompanies financial stress can have significant impacts on the lives of those who are suffering from it:

- When money is tight, people will often cut back in ways that are unhealthy. This can include taking shortcuts on self-care, not working out, and not taking advantage of health care.

- Financial stress can be a source of great embarrassment and lead to a restricted social life.

- Skipping meals or eating poorly is a common experience among people who are experiencing financial difficulties.

- Any of the other common symptoms of stress can accompany financial stress. This can include troubles going to sleep or staying asleep, upset stomach, headaches, high blood pressure, feeling tense. There are many common symptoms of stress. For more information, see The Symptoms of Stress.

How to Prevent and Manage Financial Stress

The best way to lower the impact of stress on our lives is to lead a healthy, happy life. This is true no matter what kind of stress we’re talking about.

In the context of financial stress, that means that the best way to prevent financial stress is to lead a healthy financial life. That means practicing the things that will result in financial wellness.

Fortunately, those things are known and they’re not difficult to implement:

- Having a budget and sticking to it.

- Saving for emergencies.

- Managing debt. Many people pay for emergencies on credit cards. This increases debt, increases interest expenses, and can create a downward spiral. Managing debt effectively is an important step toward financial wellness.

- Having insurance to protect against sudden great financial loss.

- Taking courses or otherwise learning how to manage finances effectively.

- Increasing income when needed by taking a part-time job, looking for a new job that pays more, asking a partner to help more or taking some other step that will increase available income.

When financial stress occurs unexpectedly, we need to know how to manage it. Fortunately, our techniques for managing any kind of stress can help:

- Stay calm and optimistic. You’ll get through this.

- Identify the real problem and what you need to solve it.

- Be practical and build a realistic plan.

- Have faith in yourself and your plan.

- Ask for help when you need it without feeling embarrassed. Everyone needs help occasionally.

How to Cope with Financial Stress

When financial stress is chronic and ongoing, we need to find a way to cope with it.

The best way to cope with financial stress is to take steps to manage and eliminate the financial stressors that are causing our stress. But, while we are working toward that, we need to cope with the current load of stress.

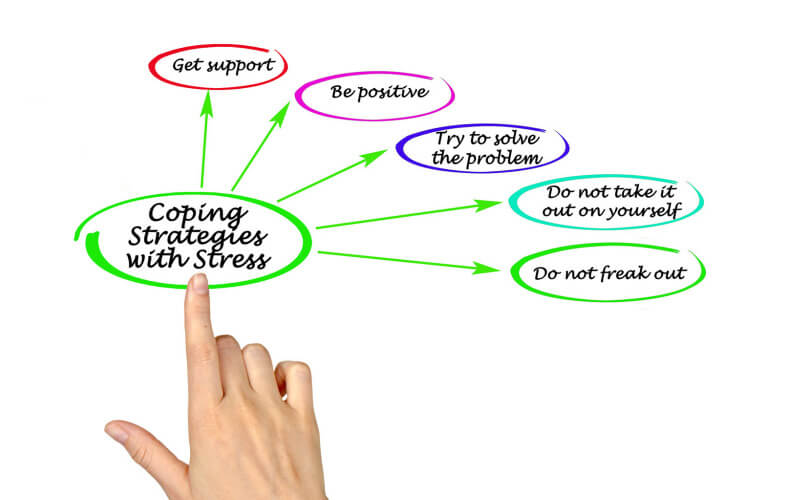

Our guides to stress provide the answer again. In Coping with Stress, we see that there are a variety of different ways to cope with stress.

Sometimes, focusing on the right problem and working to solve it will be enough. Sometimes, we need to look at our emotional response and try to reframe the problem so it isn’t so emotional. Sometimes, we just need to give ourselves a break and go for a short walk or take a nap.

In that article, we identify 7 Steps to Success:

- Identify the source of your stress.

- Identify the type of stress.

- Decide how important the stress is.

- Decide how urgent the stress is.

- Identify any consequences.

- Create a plan of action.

- If the problem seems too big, break it into smaller chunks and solve each one separately.

These steps create the framework for a plan to cope with any kind of stress – including financial stress.

It’s also important to bring our best selves to the battle when we are fighting stress. That means:

- Eating healthfully and trying to maintain a healthy weight.

- Engaging in physical activities that keep our bodies fit and moving

- Not abusing nicotine, alcohol or drugs.

- Maintaining healthy relationships.

When to Seek Help for Financial Stress

We discuss this question in general in When to Seek Help for Stress. In many ways, all stress is similar, no matter the source, and a time may come when it’s time to reach out for help no matter what kind of stress you are dealing with.

If you’re feeling overwhelmed by financial matters, it’s probably time to reach out for help. There is no embarrassment in asking for help. Everyone needs help at various times in their lives. It’s far worse to allow a problem to get bigger and bigger than to reach out for help in solving it.

Another sign of needing to reach out for help with stress is when you realize that the stress is beginning to control you instead of you controlling it. When a realistic plan of action isn’t clear, it’s definitely time to ask for some assistance.

There are many kinds of help for people who are undergoing financial stress. See What to Do in a Financial Emergency and Who to Trust for suggestions and a list of dependable resources.

The Bottom Line

Financial stress is stress that is centered around problems with money. It’s most common when folks do not have enough money to meet their financial needs or lack the knowledge of how to manage their financial affairs effectively.

As chronic stress, financial stress poses a danger to our health, our happiness and our lives and to the health and happiness of those around us. Allowing it to continue without change will almost never solve the problems that are root cause of the financial stress.

Financial stress can be prevented by using good financial management, including the use of a budget, saving for emergencies, and making sure that we can pay our bills. Many free sources of help, advice and education are available to people who are experiencing financial stress.

Like all stress, standard strategies for preventing, managing and coping with stress can help with financial stress but there may well come a time when it’s time to recognize that we need help. There are many dependable programs and resources available to help people with financial stress.

Asking for help may just be the first day of the rest of your life.