Why You Need a Balance Sheet

Related articles:

Why You Should Have a Budget

How to Create a Budget.

How to Use a Budget

What to Do and Who to Trust in a Financial Emergency

The Dangers of Financial Stress

A balance sheet is a very simple financial statement that can provide extremely important information about a person’s financial status. They are simple to build and easy to understand. But if you don’t already have a budget, you will want to create a budget first.

The Language of Money

In order to talk about balance sheets, we need to use some of the language of money. For people just starting out, the terms can be confusing so it’s best to start with some definitions.

Without definitions, there can be no shared understanding of terms.

Without a shared understanding of terms, there can be no real communication.

- Assets: These are the things we own. A house is an asset. So is a car, money in the bank, an antique painting and some vacant farmland. All of those things have a value that can be measured. A favorite old shirt might be considered an asset but it’s not an asset that would be considered in a balance sheet. Surprisingly, debt can be an asset if it’s debt that someone else owes you because then you own the debt.

- Liabilities: These are the things that we owe. Credit card debt is a very common example. Other examples of liabilities include mortgages, car loans, unpaid taxes, loans from friends or banks and student loans.

- Net Worth: This is the result we get when we subtract liabilities from assets.

If someone has $10,000 in the bank and no debts and no other property, their net worth will be $10,000. If they have $10,000 in the bank and an $8,000 personal loan, their net worth would be $2,000 ($10,000 minus $8,000).

If another person’s only possession is an old car worth $2,000 and they have $7,000 in credit card debt, their net worth would be negative $5,000 ($2,000 minus $7,000).

A positive net worth is much better than a negative net worth.

Why is it called a balance sheet?

A balance sheet is called that because it’s always in balance: net worth is always the result of subtracting total liabilities from total assets.

Our true net worth will vary almost every day, as we earn money, spend money, save money, use our credit cards to buy something and do almost anything that involves money. Under normal circumstances, we don’t really care much about those minor ups and downs in our net worth. Tracking net worth monthly, though, is pretty important if we want to keep a true picture of our finances in our minds.

How is a balance sheet different from a budget?

- A budget answers the general question “Where is my money going?” by illustrating what money is coming in and what money is going out.

- A balance sheet answers the question “What is my net worth?” by illustrating current assets and liabilities.

Why is that important? Let’s look at two examples:

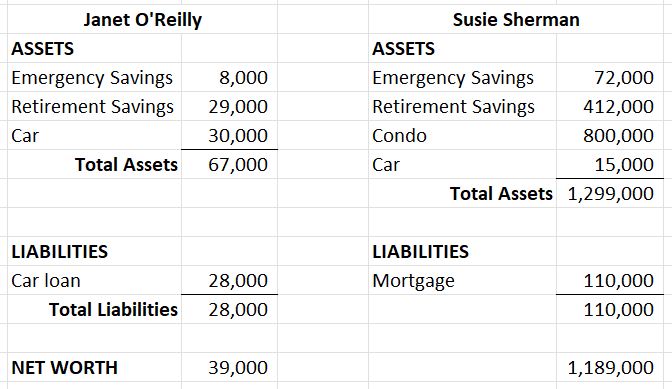

Janet O’Reilly and Susie Sherman are long-time friends. Both are 51 years old.

- Janet O’Reilly works for a company. She earns $85,000 per year and takes home $72,000. That’s $6,000 per month. She always pays her bills on time, saves money for emergencies and retirement every month, enjoys her life and always has a little money left over at the end of the month.

- Susie Sherman works for the same company. She earns the same amount as Janet O’Reilly and also takes home $72,000. She too pays her bills on time, saves money for emergencies and retirement every month, enjoys her life and always has a little money left over at the end of the month.

Which woman will be better able to weather a financial emergency?

The answer is that we don’t know. We sort of know what their budgets look like but we don’t know anything about their assets and liabilities. Specifically, we don’t understand their respective net worth.

Let’s add some detail:

- Janet O’Reilly has $8,000 saved for an emergency. She also has $29,000 saved for retirement. She lives in an apartment that is pricey but she enjoys it. She owns a brand-new $30,000 car but owes $28,000 on her car loan.

- Susie Sherman has $72,000 saved for an emergency. She has $412,000 saved for retirement. She lives in a condo that is valued at $800,000. Her outstanding mortgage is $110,000. She drives an older car that is worth $15,000 but she has no car loan on it.

Now we have a better understanding of the financial position of Janet and Susie. Let’s calculate their net worth:

Now that we see each woman’s net worth, we can easily state that Susie is in a much better position to weather a financial emergency than Janet.

As we go through our financial lives, it’s a good goal to see our net worth constantly increasing as we accumulate assets and shed liabilities.

Balance Sheet Classifications

For a simple balance sheet, it’s easy to just list every asset that a person owns as well as every liability. That’s convenient and helpful when the number of assets and liabilities is small. For example, it can be helpful to see the current value of each of our two cars shown separately as well as the value of each of our car loans.

However, when there are multiple assets or liabilities of the same type, showing each one in a balance sheet can make it cluttered and possibly less helpful. In those cases, we can use balance sheet classifications.

All that means is to group assets and liabilities together in ways that make sense and then just list the total in the balance sheet.

For example, if someone has 12 credit cards, they may want to see each one listed separately in their balance sheet just so they’ve got a place to see those card balances in one glance. Someone else might not want to see all that detail in their balance sheet. Instead of listing each card, they’d have a liability called CREDIT CARDS. The total of CREDIT CARDS at any time would simply be the total due on all of their credit cards.

Similarly, if someone has lots of checking or saving accounts, they might want to group the checking accounts together in one group and the saving accounts in another group just to simplify the balance sheet. For a personal balance sheet, it’s really just a matter of preference.

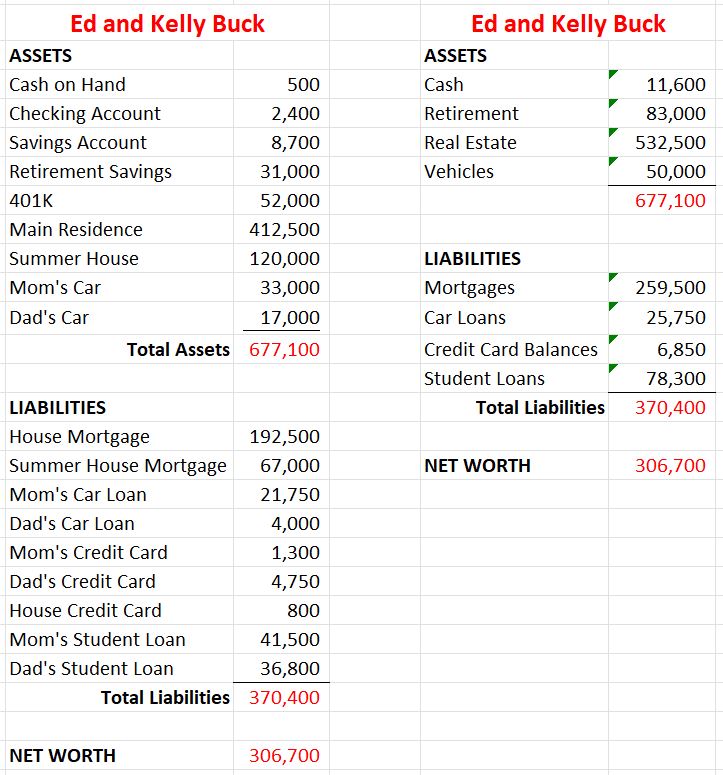

This example shows two different balance sheets for Ed and Kelly Buck. On the left side, they list all of their assets and liabilities. On the right side, they’ve grouped them into categories.

The advantage of the balance sheet on the left side is that they can clearly see everything that they own and owe. The advantage of the balance sheet on the right side is that they can easily see how much cash they’ve got, the total of their retirement accounts and so on.

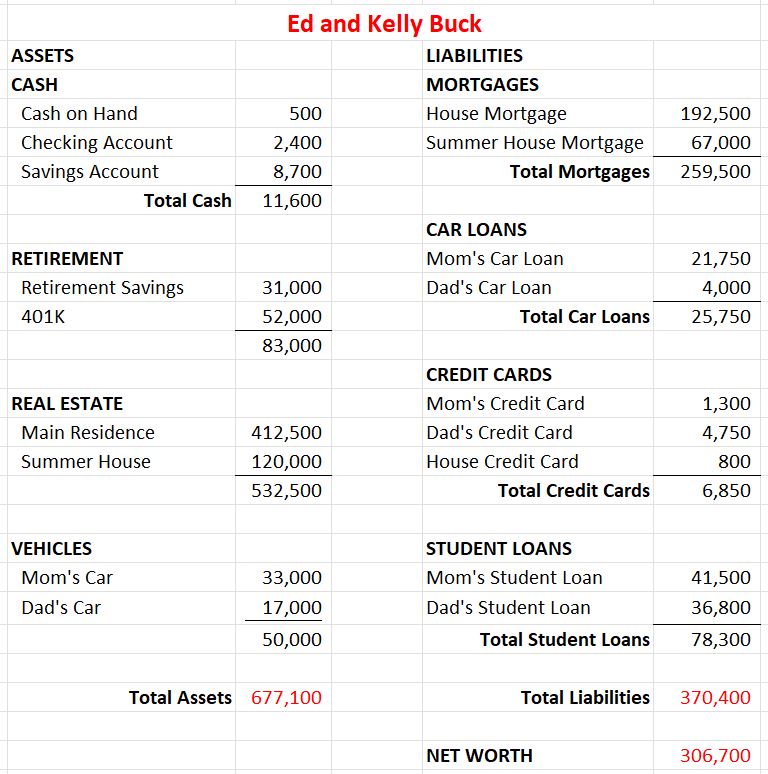

There’s a middle approach that can provide the best of both worlds by listing every asset and liability but also providing sub-totals for each sensible group of assets and liabilities.

All three balance sheets for Ed and Kelly Buck show the same net worth at the bottom. All three show the same values for total assets and total liabilities. All three can work for a personal balance sheet.

It doesn’t really matter which format you use for your own balance sheet so long as you are able to easily and clearly answer the following three questions at any time:

- What are my assets and how much are they worth?

- What are my liabilities and how much do I owe?

- What is my current net worth?

In our examples here, we’ll list every asset and every liability for the sake of simplicity.

How do I create a balance sheet?

As with budgets, there are lots of ways to create a balance sheet. If you are using an app for your budget, it probably already provides a balance sheet for you. If you are using paper and pencil for your budget, you can use a calculator to keep your balance sheet up to date.

If you are using a spreadsheet to track your monthly budget, it will make sense to just add your balance sheet right below your budget. That will make it easy to use changes in your budget to track changes in your balance sheet.

For example, if you add money to savings every month, then the value of that asset will grow month by month in your balance sheet.

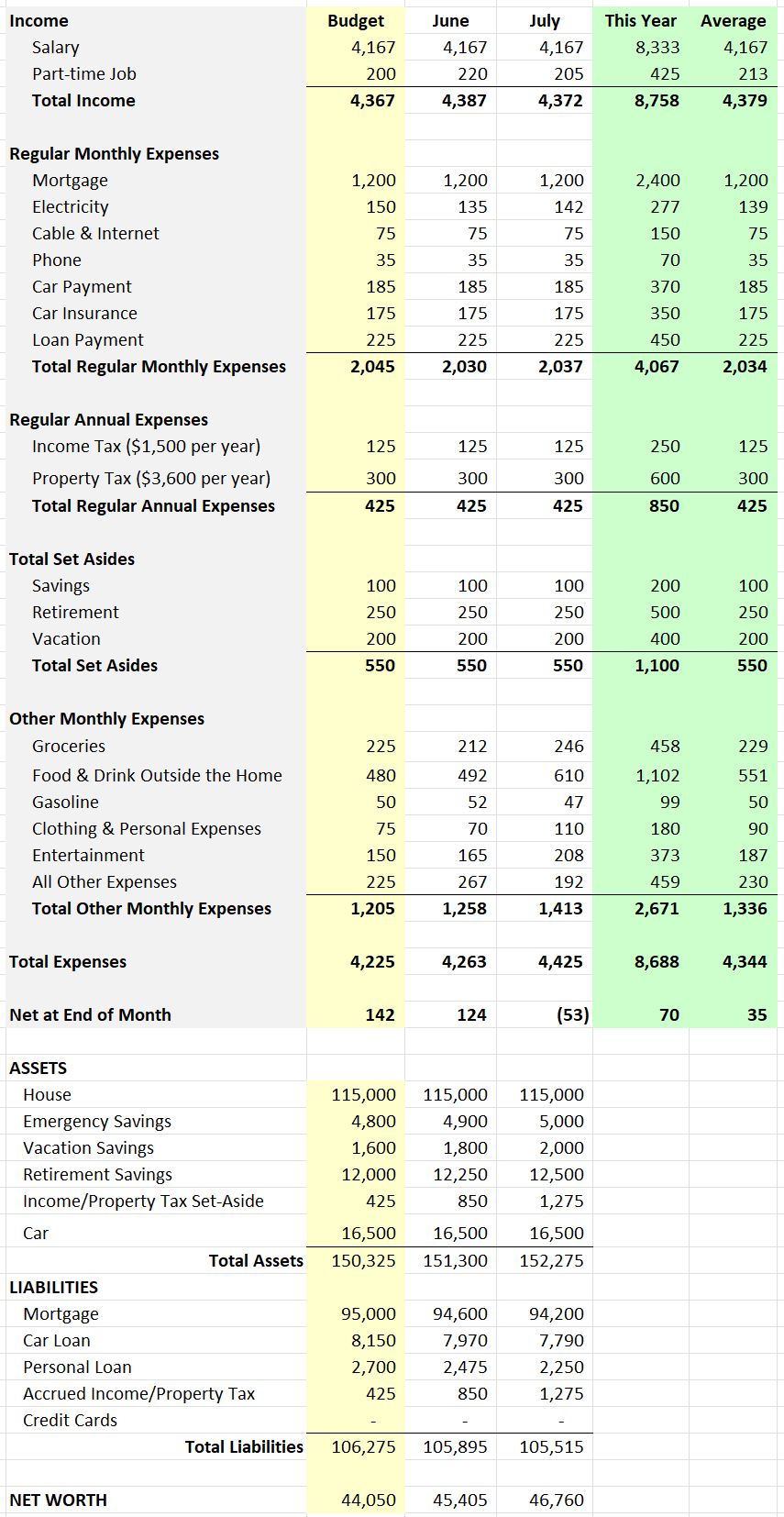

In How to Create a Budget, we met Peter who decided to create his first budget. In How to Use a Budget, we saw Peter’s budget in action as he started tracking income and expenses every month. We can now add a balance sheet below Peter’s budget. The only information we need is the starting value of his assets and liabilities.

In those articles, we learned that Peter has $4,800 in savings and $12,000 in retirement savings. He also owns a house that is worth $115,000 but he has a $95,000 mortgage. His car is worth $16,500 but his car loan still has $8,150 to go.

Here’s Peter’s budget with his new balance sheet below it:

As we can see, Peter’s net worth is increasing a small amount each month as he adds to his savings and pays off his loans.

It’s also worth nothing that Peter has been setting aside money every month so he’ll be able to easily pay his property and income tax when they come due at the end of the year. The money he has in the bank to pay those taxes is clearly an asset since it’s cash on hand. But, in reality, his taxes have also been accumulating across the year. That’s why we list the cash in the bank as an asset and then the same amount as an accrued tax liability.

That reflects reality: Peter has put the money in the bank but he’s going to spend it all at the end of the year to pay those tax bills. From the point of view of net worth, the money in the bank and the growing taxes cancel each other out.

The Bottom Line

Budgets are a terrific tool for managing personal finances and helping us make dreams come true but they only tell part of the story. For a true understanding of where we stand financially and our chances of weathering a financial emergency or making a dream come true, we need to have a personal balance sheet.

Fortunately, balance sheets are easy to create and easy to understand. Even better, they can be linked to budgets to show how our net worth is changing from month to month.

If financial stress is driving you crazy, we can help: see The Dangers of Financial Stress.