How to Use a Budget

Related articles:

Why You Should Have a Budget

How to Create a Budget.

Why You Need a Balance Sheet

What to Do and Who to Trust in a Financial Emergency

The Dangers of Financial Stress

In this article, we’ll look at a few ways that a budget can be used. If you would like to understand why you should have a budget, see Why You Should Have a Budget. If you don’t already have a budget but would like to create one, check out How to Create a Budget. Finally, if financial stress is driving you crazy, we can help: see The Dangers of Financial Stress.

Budgets can be helpful in many ways but here are a few of the most common ways to use a budget:

- Tracking income and expenses

- Keeping spending under control

- Identifying potential financial problems and solutions

- Planning for emergencies and retirement

- Ensuring that you are focusing on your short-term and long-term financial goals

- Recognizing when financial problems require some outside help

Tracking income and expenses

The most basic function of a budget is to allocate money in a way that will help someone meet their goals. For most people, it makes sense to have a monthly budget. Money received each month is recorded as “Income”. Money going out each month is recorded as “Expenses” or “Set Asides”. A set-aside is just money that is being set aside for some future purpose, like emergencies, retirement, a new house or an upcoming vacation.

When a budget is first created, it will have target spending amounts for various expense categories like “Mortgage”, “Groceries” and “Entertainment”.

In many cases, the amount actually spent during a month will not exactly meet the targeted amount. If a mortgage payment is the same amount every month, then that should always meet the amount budgeted for it. On the other hand, the amount of money spent on groceries will probably never be exactly the same as the amount you have budgeted for it.

That’s okay: budgets are not straitjackets. Instead, they are guidelines, much like the guiderails on a highway. When driving down a highway, your car can move back and forth a bit but you do want to keep it moving ahead and staying on the road.

That is accomplished by recording actual income and expenses in your budget. Some people like to do that once a month. Others prefer to update their expenses weekly or daily because recording expenses on a frequent basis makes it a very easy task. Either approach is fine.

At the end of each month, you’ll have a new column of expenses to compare to your budgeted amounts.

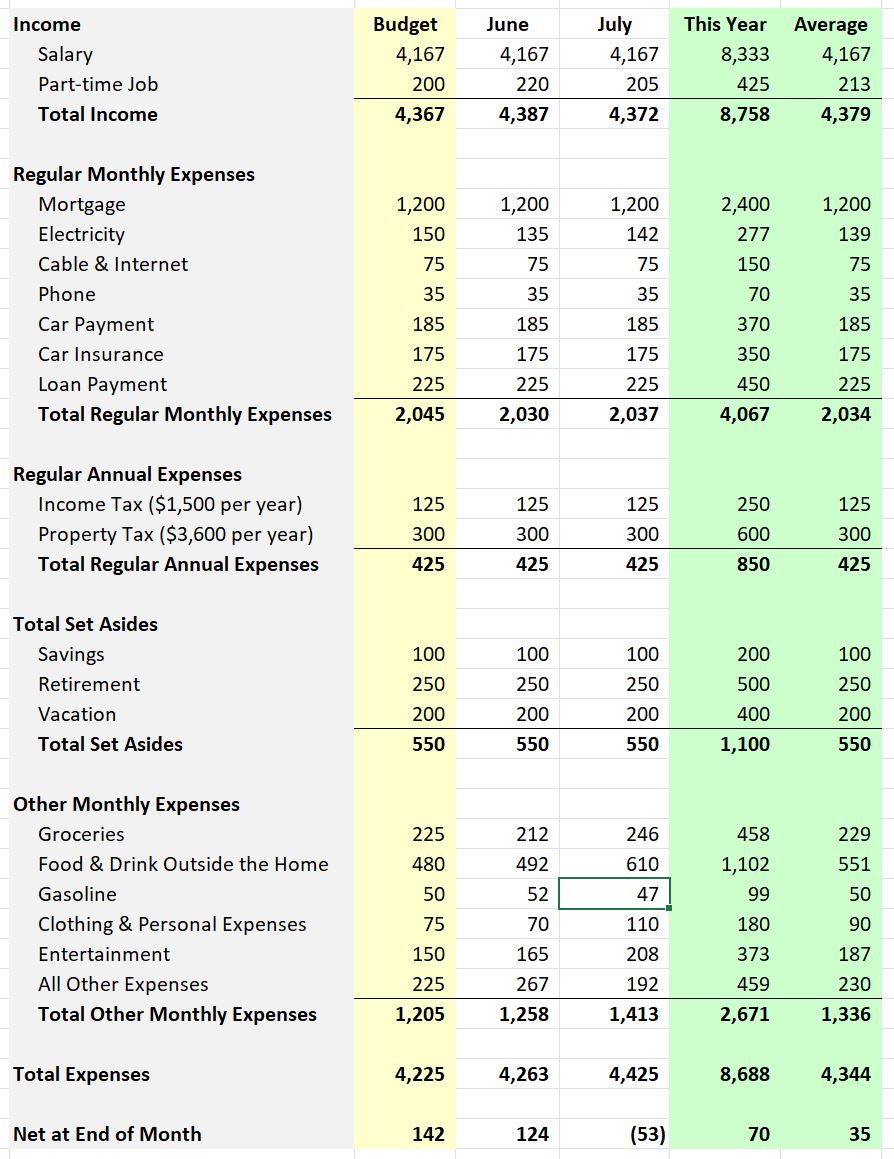

In How to Create a Budget, we were introduced to Peter and his partner, Mary. Peter created his first budget at the end of May. At the end of each month, he has recorded his actual income and expenses. He also added a summary column so he could see how much he had spent so far in first year of budgeting and the average he was spending in each month.

At the end of the first two months, his budget looked like this:

His budgeted amounts are in the yellow column. The next two columns show his actual income and expenses in June and July. The next column shows totals for the year so far and the last column displays his average monthly income and expense.

Looking at Peter’s budget, we can see that some expenses are the same every month, like his mortgage payment or his car payment.

Some other expenses are pretty close to the budgeted amounts each month but vary a little. Peter’s income from his part-time job is like that.

Finally, some expenses vary by more each month as Peter goes about his daily life. Groceries, Food Outside the Home, Personal Expenses and Entertainment all vary from month to month. That’s to be expected.

Budgets are great tools to help us keep spending under control.

Keeping spending under control

One of the best uses of a budget is to keep spending under control. If we all had unlimited amounts of money, there would be no need for budgets. However, without unlimited amounts of money, it’s important to make sure that we’re spending our money on the things that are most important to us.

Peter notices that his spending on “Food & Drink Outside the Home” is increasing. He and his partner, Mary, have been spending more time at a local restaurant with friends and the result is showing in his budget. Last month, he spent more money than he had budgeted and had to cut into his savings to cover the difference.

Peter showed Mary the budget. Since they’re planning on marrying, he felt it would be a good idea to begin including her in financial decisions.

When she saw the budget, recognized the problem right away. She suggested to Peter that instead of always eating in the restaurant with their friends they should alternate having a night at each other’s home on a regular basis. Doing that would save both them and their friends some money without reducing the amount of time or fun they would be having with their friends.

Identifying potential financial problems and solutions

A budget can be a big help when thinking about the impact of financial difficulties. Looking carefully at the budget can often suggest potential solutions.

Peter has heard that the factory may have to lay off some workers. While he thinks his job is secure, it might not be. He and Mary want to know what they would do if he lost the job. The job market is pretty good and Peter thinks he can probably find a good job in about three months if he is laid off. That means they would need to survive for about three months without his salary.

Looking at the budget, they see that they would need to find about $4,000 per month to replace Peter’s missing salary.

The first place would be to stop the set asides until he finds a new job. That’s $550 per month.

Next, Peter has been putting $425 into a savings account each month for his regular annual expenses. They decide that they could pause that and then make up the difference after Peter finds a new job. Added to the $550, they are now up to $975.

Mary suggested that not eating or drinking out until a new job was found would be a good idea. Groceries would increase a bit but she said “We both know how to cook good food cheap.” That’s another $450 saved, which brings the total up to $1,425.

Mary looks at the budget again and suggests that they won’t need to buy clothes or spent money on entertainment if Peter is out of work. “We can watch TV and eat popcorn!” That’s another $200 saved. They are now up to $1,625.

Peter realized that he could increase his hours at his part-time job and double his earnings there. That’s $200 more income, which increases the total to $1,825. Mary is in school but says that she can work in her father’s store part-time and take home about $300, which increases the total to $2,125.

Peter has been saving $100 per month for emergencies for the last four years. Right now, he has $4,800 in his savings account. If they divide that in three, they would have $1,600 more to add their total for each of the first three months. Now they’re up to $3,725. They’re within $275 per month of covering Peter’s missing salary for three months. Looking at the budget one more time, they see that there’s nothing more to cut without missing payments and endangering their good credit rating.

Peter has been saving $250 per month for retirement and has $12,000 in that account. He and Mary do not want to touch that money but agree that, in a dire emergency, they could “borrow” from the retirement account and then pay that money back when the emergency is over.

If Peter could find a new job in three months, as he expects, then they’d be in pretty good shape but their emergency savings would have been completely exhausted on this one emergency. They would need to try to build it back up as quickly as possible.

Working through the numbers allows them both to feel confident that, should Peter be laid off, they have a realistic plan for staying afloat until Peter has found a new full-time job. If a new job isn’t available after the first three months, they would need to take about $2,000 per month from Peter’s retirement savings. That’s not a good thing to do but at least they know that they could survive for nine months without Peter’s salary and without running out of money.

Using a budget in this way to consider the impact of potential emergencies can provide a good plan for an unexpected emergency. It also provides the kind of confidence that lets people sleep well at night without worrying about money.

Planning for emergencies and retirement

Every budget and financial plan should contain a plan for emergencies and retirement. The scenario just above demonstrated how savings – both short-term savings for emergencies and long-term savings for retirement – can play a real part when financial emergencies arise. Even better, a budget can make it easy to create a contingency plan when a financial emergency is still just a possibility.

Over the years, savings for emergencies should grow. The first target should be to have at least $1,000 saved for emergencies. The next target is to have enough money saved for emergencies to cover three months of normal spending. Eventually, it’s a good idea to have enough money saved for emergencies to cover an entire year’s worth of normal spending.

Retirement savings are similar except we hope there are no emergencies involved. Money saved for retirement and invested wisely will grow and grow and grow over the years and decades. People who start saving for retirement in their 20s will almost always have far more money to retire on than folks who wait until they are in their 50s or older.

A budget makes it easy to set aside money for emergencies and retirement because they are treated just like any other bills. The only difference is that you are paying yourself instead of someone else.

Most goals require money. Budgets can really help us plan for our goals and increase our ability to turn our dreams into reality.

Ensuring that you are focusing on your short-term and long-term financial goals

One of the best uses of a budget is to focus us on our short-term and long-term goals. Most of the things we would like to do in the future will cost at least some money and some things will cost a lot of money. Without the money, we won’t be able to do the things we want to do.

For each short-term or long-term goal, the questions are pretty easy:

- Is this something that we would really like to do?

- How important is this to us when compared to our other goals?

- How much money will we need?

- When will we need the money?

- Can we cover it by adjusting our spending in the budget?

- If no, can we increase our income in some way to cover the money we will need?

Fortunately, the threat to Peter’s job passed and he remains employed at the factory. He and Mary are going to get married next year. They would like to buy and furnish a larger house within three years after they get married.

Peter has some equity in his current house but they think it might not be enough to cover a down payment on a larger house and they will need to buy more furniture. They talk it through and decide that they will probably need about $25,000 plus the equity in Peter’s current house in order to swing a new home and at least some new furniture.

And then there’s the upcoming wedding. Mary’s friends have all had expensive weddings but Mary has seen them struggle financially after those weddings. She and Peter decide that the new house is more important to them than a fancy wedding. Peter’s parents have a large yard and offer to host a nice wedding in a tent. That sounds great, so their budget for the wedding will be small. They decide to keep their total wedding expenses to $5,000.

That’s $30,000 to find over the next 36 months. That’s $833 per month to find in the budget. How will Peter and Mary be able to cover that $30,000?

Peter notes that his loan will be paid off in one more year. That will save $225 per month for the last 24 months. That’s $5,400.

They look at the budget again and decide to chop dining out in half. That saves $240 per month. Over 36 months, that’s $8,640.

Mary then decides to take that part-time job at her dad’s store. She’ll take home $300 per month. Over 36 months, that’s $10,800 of additional income.

So far, they’ve identified savings of $14,040 ($5,400 + $8,640) and $10,800 of additional income. Adding those together equals $24,840. They’re already within about $5,000 of their $30,000 goal.

Peter talks to his boss at the landscape company and they agree to increase Peter’s hours for the next three years. That will bring in another $150 per month in new income. Over three years, that’s $5,400.

With a little help from their budget, they have just built a plan that will allow them to enjoy their wedding, buy a larger house, and get started on furnishing it.

Some financial problems are very difficult to solve on our own. That’s when it’s time to ask for help from trusted resources.

Recognizing when financial problems require some outside help

Sometimes, a budget will demonstrate clearly that there’s a big gap between expenses going out and money coming in. If you don’t have enough savings to cover the gap and you can’t increase the amount of income, things can get desperate pretty quickly.

This might seem like bad news but, from a budgeting point of view, it’s actually not all bad news.

Look at it this way: if you’re barreling down a highway at 80 MPH and there’s a sharp curve with a steep drop-off just ahead, would you prefer to see a sign that says “30 MPH JUST AHEAD” or would you prefer to enter the curve without any warning?

A warning sign can alert you in time to slow down so you can navigate the curve safely. Without a warning, entering a 30 MPH curve at 80 MPH could be deadly. For most folks, that’s a pretty easy choice.

The same is true with our finances. The earlier we can spot a problem approaching, the more time we’ll have to deal with the emergency. But some emergencies will be beyond our ability to solve by ourselves.

That’s the time to ask for help. Some people decide not to think about money when times are tough but that’s the exact wrong approach. There are many sources of help for people who are experiencing financial difficulties. When a financial crisis is too hard to solve on our own, the best approach is to seek outside help.

There are many charlatans who say that they can solve all our financial problems if only we pay them in advance. These so-called experts are to be avoided at all cost. Instead, in the event of financial difficulties, it’s important to turn to trusted outside sources of help. We look at these trusted sources in Who to Trust in a Financial Emergency?

Personal Balance Sheet

A budget answers the question “Where is my money going to?” A balance sheet answers the question “What is my net worth?”

A balance sheet is a very simple add-on to a personal budget. Balance sheets provide additional information that can be extremely helpful when making long-term plans or trying to solve short-term problems. We discuss personal balances sheets in Why You Need a Balance Sheet.

The Bottom Line

Budgets are a terrific tool for managing personal finances and helping us make dreams come true. To be useful, though, they must be accurate and they must be kept up to date. Monthly income and expenses should be recorded at least monthly but some people prefer to record things more often.

If you choose to use an app to create your budget, some apps will automatically record at least some expenses for you if you link the app to your checking account. (But do think carefully about security!)