How to Create a Budget

Related articles:

Why You Should Have a Budget

How to Use a Budget

Why You Need a Balance Sheet

What to Do and Who to Trust in a Financial Emergency

The Dangers of Financial Stress

Let’s begin by clearing up a few misconceptions about budgets:

- Creating a budget doesn’t have be painful or tiresome. To begin, you will just need to gather some simple information.

- Creating a budget doesn’t have to take a long time. If you want to start with just a rough budget to see where you are, you might be able to get that done in just a few minutes.

- Using a budget is easy. Using a budget might seem like it will be time-consuming but it’s actually pretty easy once you understand the process.

- A budget isn’t a chore. Instead, it’s the easiest way for you to take control of your money and help you achieve your goals.

Money and Timeframes

A budget is all about money: money in and money out. But a budget is also about timeframes. People often think about a monthly budget or an annual budget. A financial plan can be thought of as a budget that goes far into the future so a 10-year financial plan is, in many ways, a 10-year budget.

The Language of Money

In order to talk about budgets and financial plans, we need to use some of the language of money. For people just starting out, the terms can be confusing so it’s best to start with some definitions.

Without definitions, there can be no shared understanding of terms.

Without a shared understanding of terms, there can be no real communication.

Money coming in

- Gross Income: This is the total amount of money you have earned in a month or a year or some other period.

- Net Income: This is what remains of your gross income after all taxes and deductions have been subtracted. We don’t care about gross income with budgets because you can’t spend money that’s already been deducted from your paycheck. Net income is the amount you have to spend so that’s what’s important for a budget.

- Total Net Income: If you have only one job or one source of income, then your Total Net Income is the same as your Net Income. However, if you have multiple jobs or multiple sources of income, Total Net Income is the sum of your net income from all sources.

- Average Net Income: If you don’t receive a steady paycheck from one job or if you two sources of income and one of them varies from month to month, then the total amount of money that you have to spend each month will vary. In this case, you will want to look back at your total net income for the last 6 or 12 months and calculate an average net income to work with budgeting purposes. That will be accurate enough for most budgets.

Money going out

- Regular Monthly Expenses: These are the regular payments you make every month. In many cases, the amount will be the same from month to month. Regular monthly expenses would include things like a mortgage payment or rent check, a car payment, an insurance payment, the electric bill, Netflix, a student loan payment – everything you pay every single month.

- Regular Annual Expenses: Most folks have certain things that they pay every year. It might be property taxes or it might be a regular amount due to the IRS. No matter what it is, it can be uncomfortable needing to pay a large sum when it comes due. The best way to prepare is to put these regular annual expenses in your budget. But how do you put an annual expense in a monthly budget? Simple: you estimate the annual amount and then divide that by 12. Then you include a Set Aside in your monthly budget for that amount. After 12 months, you will have set aside enough money each month to allow you to pay the annual expense without difficulty.

- Savings Set Aside: A savings set aside is simply the amount of money that you will set aside for the future, probably by putting it in a savings account.

- Retirement Set Aside: Just like a savings set aside, a retirement set aside is money that you are setting aside for your own future retirement.

- Other Monthly Expenses: This includes everything else you spend money on in a month or a year. The amount you will spend on these things each month will probably vary from month to month, unlike something like a rent check or a mortgage payment. Other monthly expenses include things like groceries, eating out, having fun, buying gas for a car, clothing, coffee at Starbucks… whatever you are spending money on.

Getting Organized

- Period: From a budget point of view, a period is simply a period of time. Common periods used for budgets include months, quarters, years, 3-year periods, 5-year periods and 10-year periods. Most folks who have a budget will have a monthly budget. Most monthly budgets will also allow you to look at totals for year-to-date, so a monthly budget also serves as an annual budget.

- Expense Category: The purpose of a budget is to allow you to understand your own finances, manage your money successfully and make sure that your expenses are aligned with your own goals. If we only had totals for “money in” and “money out”, a budget wouldn’t be very helpful. Instead, we group expenses into expense categories so we can see how much money we’re spending on different things. A typical personal budget might have expense categories similar to the ones below but the right categories will vary from person to person.

- Housing

- Transportation

- Health

- Insurance

- Groceries

- Food/Drink Outside the Home

- Savings

- Retirement

- Vacations

- Other

Dreams can come true with a little bit of careful planning.

Start Dreaming

This is the beginning of the fun part. It’s time to sit back and dream a bit.

What are your life goals? Where do you want to be in a year? In 5 years or 10 years or 25 years? When do you want to retire? Is it your goal to travel all around the world as often as possible? Or would you prefer to start buying rental properties and build a real estate portfolio?

What do you want to do with your life?

A great deal of what we can do with our lives is constrained by money. The best way to eliminate those constraints is to budget for the things we consider most important. If that means spending less in other areas, well, that’s worth it if we’re making progress on the things we really care about most.

If you’re planning on taking a big vacation next summer, then your monthly budget should probably include setting aside money for that goal. That would be a vacation set aside.

Emergencies

Every financial plan should include plans to handle an emergency.

Emergencies come in all sizes. It would be good to get to a point where you have enough money saved to cover all of your expenses for an entire year if need be. Before that, it would be good if you have enough saved to cover three months’ worth of expenses. And before that you should aim at having at least $1,000 in savings to cover an emergency.

What this means is that your budget should an emergency set aside every single month until you are satisfied that your emergency fund is large enough to reasonably handle any emergency you are likely to encounter.

Retirement

If you aren’t retired, then you should be thinking about retirement, no matter how far away that is.

A solid financial plan should include a plan to build a big enough retirement fund to allow you to retire and comfortably enjoy your retirement without financial stress.

That means that your budget should also include a monthly retirement set aside.

Order your priorities

If you’re like most of us, you have so many things that you’d like to do that your budget probably won’t accommodate all of them. If so, it’s time to make some choices. Once you’ve identified your priorities, decide which ones are most important to you and which ones can be left for later.

One word of caution: if you put food at a lower priority than vacation, you might end up being hungry! And if you put retirement and emergencies behind vacation and Starbucks, you might end up looking back and shaking your head and wishing you had made better choices.

The choices are yours but choose wisely.

What’s Really in a Budget?

In its simplest form, a budget is simply a column of numbers.

The money coming in will be at the top, followed by all of your expenses and set asides. At the bottom, the total of your expenses is subtracted from your income.

If your expenses are greater than your income, you need to lower some expenses or increase your income. If your total expenses are less that your total income, you can add the amount left over to your savings account.

The journey of a thousand miles begins with a single step.

Gather Your Information

Your budget needs to be accurate. If it is not accurate, it won’t be useful. Worse, an inaccurate budget might convince you to make some very poor financial decisions.

That means you need to be able enter accurate information about your income and spending. The best way to get your income information is to either look at your paycheck or look back at your checking account for the last 6 or 12 months and figure out your average monthly income.

Some expenses will be easy to identify. The rent or mortgage should be easy. How much you spend on groceries or eating and drinking out may be more difficult.

If you can determine what you have spent in the past, then you can use those numbers for your initial budget. If not, you can start by keeping track of all your expenses for the next 30 days and using those totals. Or you can wing it and try to estimate your current spending. No matter which approach you use, tracking your expenses going forward will help you refine your budget quickly and improve its accuracy.

Create Your First Budget

To create your own budget, you can use a pen and paper, a spreadsheet or a budgeting app. They will all work just fine, so choose the tool that you are most comfortable with. The numbers will work out the same no matter which tool you use. We’ll assume that you’re starting with a pen and paper.

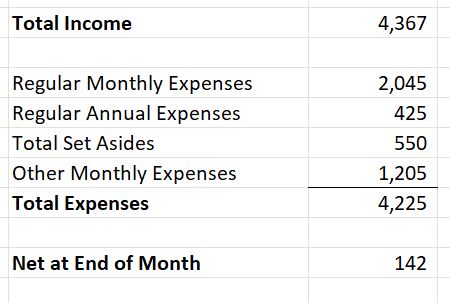

- Make two columns. The left column will contain descriptions and the right column will contain amounts of money.

- In the first line, put “Income” in the left column and your total net income or average net income on the right.

- In next few lines, put the following descriptions in the left column and the corresponding totals in the right column:

- Regular Monthly Expenses

- Regular Annual Expenses

- Total Set Asides

- Other Monthly Expenses

- In the next line, enter “Total Expenses” on the left and enter the total of all of your expenses and set asides on the right.

- In the next line, “Net at End of Month” in left. In the right enter the value you get when you subtract “Total Expenses” from “Income”. This is the money remaining after you’ve paid for all your expenses and set aside money for all your Set Asides.

That’s it: Now you have a budget. It’s a very, very simple budget but it’s still an accurate budget if the numbers you entered are correct.

Peter is 26 years old. He has a full-time job at a local factory and a part-time job working for a landscaping firm.

He’s ambitious and tries to be careful with money. He owns a small home that he bought four years ago but he’s thinking about getting married and that might mean buying a larger home. He’s managed to accumulate some savings by being careful but he’s worried that he might not make enough money to cover the increased bills that might come with a marriage.

He decides to create a budget to see where his money is actually going every month. His father suggests looking at the last six months of his online checking account to see how much money was coming into the account and how much was going out.

- His salary at the factory is $63,000 per year. After taxes and deductions, he takes home $4,167 each month. He also brings home about $200 per month from his part-time job. That means that his net monthly income is $4,367.

- His regular monthly expenses go to his house, his car and a loan he took out to buy furniture. Those add up to $2,045 per month.

- Each year, he has to pay about $1,500 in income tax and about $3,600 in property tax. Those add up to $5,100 per year. Divided by 12, he has to set aside $425 every month in order to be able to pay the $5,100 when it comes due each year.

- He adds $100 per month to his savings account and $250 to his retirement account. He’s also setting aside $200 each month so he can take his girlfriend for a nice vacation next year. That means he’s setting aside $550 per month.

- When he adds up all of his other expenses, they total $1,205 per month.

With this information in hand, he can create his first budget:

It looks like Peter is doing okay right now because he’s saving for an emergency, saving for a retirement, paying off his loan and still ending up with $142 left at the end of the month. He can do whatever he wants to do with that money but the smart move would be to just add that extra $142 to his savings account.

Because this budget doesn’t have any detailed information in it, it’s really a “summary budget”. Summary budgets can be very helpful for some things but for a personal budget you really need to see more detail.

Fortunately, it’s really easy to turn your summary budget into a detailed budget.

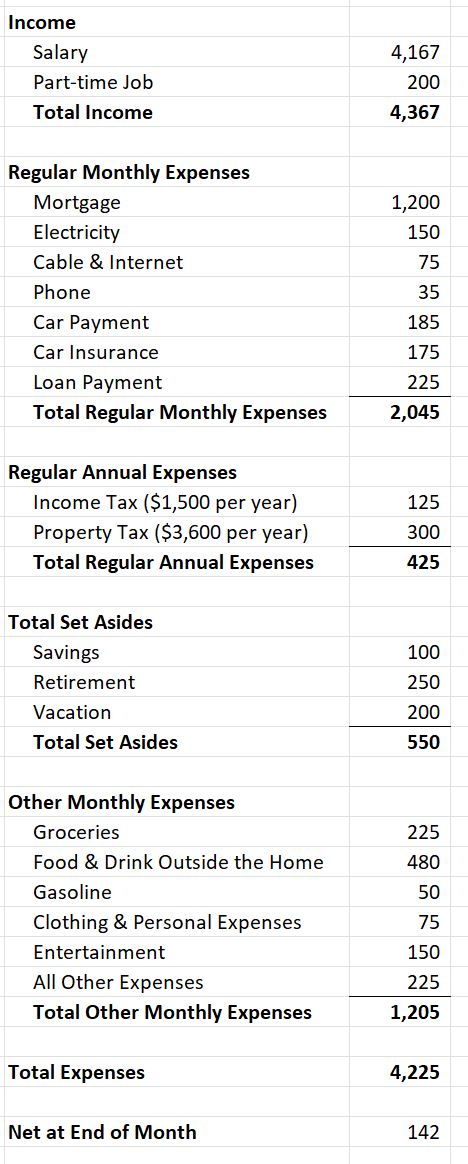

Create a Detailed Budget

When you created your summary budget, you entered totals for things like Regular Monthly Expenses and Total Set Asides. Now it’s must a matter of adding a few more lines to your budget.

- Under the title “Regular Monthly Expenses”, add lines for each of your regular monthly expense categories. For example, you might have categories for Housing, Insurance, and Loan Payments. After each of those category names, enter the monthly total for expenses that belong in that category. When you’ve done entering the categories, the total of the numbers you have added should be the same as the total you previously added for “Regular Monthly Expenses”.

- Under the title “Regular Annual Expenses”, add expense categories for each of the things that belong in that group. Examples might be “Property Taxes” and “Income Taxes”.

- Under the title “Total Set Asides”, add lines for each of your set asides. Typically, this would include lines for “Savings” and “Retirement”. If you have decided to set aside money for a vacation, then you will want to have a line for “Vacations” in your set asides.

- Under the line “Other Monthly Expenses”, add lines for all of your remaining expenses. This will include lines for things like “Groceries”, “Eating Out”, “Entertainment”, and “Other”.

That’s it. The totals for each part of your new detailed budget should be the same as the totals in your summary budget. The only difference is that your detailed budget will give you a far better understanding of what money is coming in and how you are spending it.

Peter quickly realizes that he needs more information than his simple budget provides.

Fortunately, when he looked back at the last six months in his checking account, he kept track of each of the different types of things he was spending money on. That made it easy for him to add some detail to his budget.

The totals and the bottom line are still the same as in his first simple budget but now he has a much better understanding of where his money is going. He also has a good tool that will let him think about how he might be able to swing a larger house or cover some extra expenses after he gets married.

The data he needed to create his budget was there in his online checking account all the time but it wasn’t in a useful format. Now he can make some decisions with confidence.

The Bottom Line

Once you’ve got the hang of them, budgets are pretty simple to create and use. They are the best tool available to help you understand your finances, make solid financial decisions, make sure your money is being spent on the things you care most about, and help you plan for the future. That’s a lot of bang for a relatively small amount of effort.

If you’re ready to learn how use to a budget to take charge of your finances, see How to Use a Budget.